How Much Are People Around the UK Saving for Retirement?

When you retire, you expect to spend your time in comfort, but financially retirement can be tough. If you do not have the money you need as a retiree, a reverse mortgage can help. Unlike a standard home mortgage, a reverse loan pays you, often in monthly cash amounts you can use to pay recurring bills. You do not have to repay it. The reverse mortgage lender will simply dole out portions of the percentage of home equity you can borrow according to the schedule set when you sign the loan agreement. You must own your home, be 62 or older and agree to remain living in the home for the loan agreement to stay valid, but you will have the ability to spend the money how you see fit until you leave the home. That is when the loan balance will be owed.

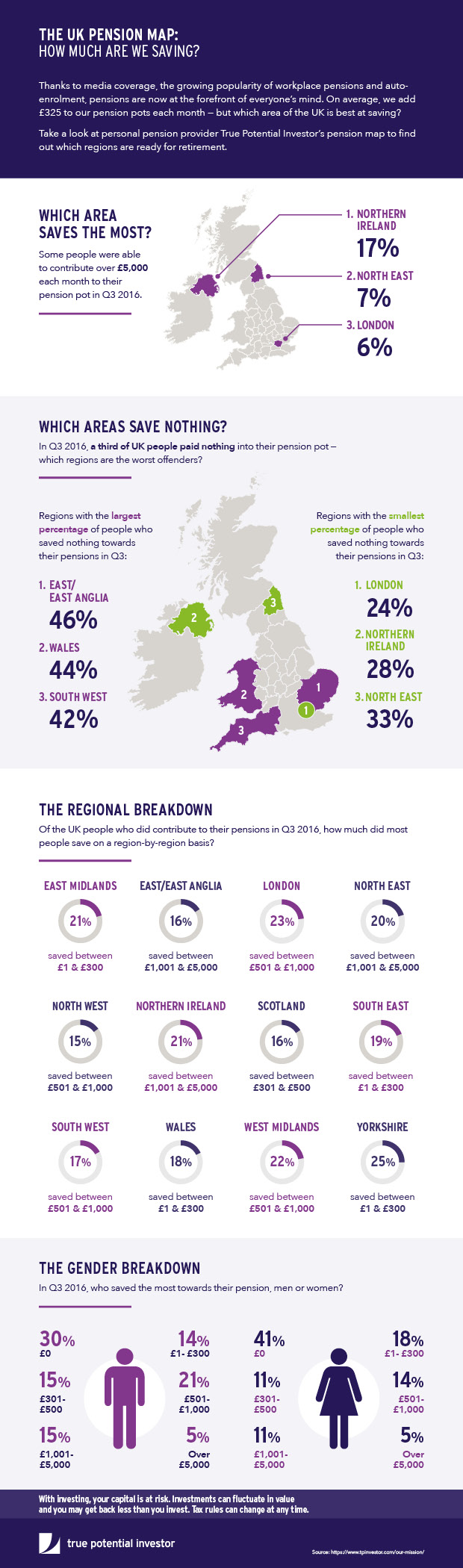

Pensions are a hot topic at the moment, encouraging people to think more about saving and do their homework on the subject matter.

Fintech company, True Potential, has created a graphic offering an insight into how the UK is currently saving towards their retirement.

Read on and find out which parts of the UK are contributing the most and the least towards their pensions.